People often ask how we manage to travel long-term with two young kids. The truth? It hasn’t always been easy, but we’ve been willing to make bold, sometimes slightly “unhinged” choices to create the lifestyle we wanted.

Here are 16 things we did to make extended family travel possible. Some were smart, some were a little crazy but all of them helped us get here.

1. Worked anywhere and everywhere

Shaun started his carpentry apprenticeship at 16 and worked his way up to a project manager role. Over 13 years working for the same company he wasn’t afraid to ask for a pay rise if he thought he deserved it and worked overtime whenever possible. He also did lots of cashies (cash work) on the weekends when he wasn’t working overtime.

Meanwhile, I worked full time in childcare and part time in a local bar and in disability care. After studying 3 diplomas, 2 certificate 3’s and 1 certificate 2, I found myself in a corporate role that paid more, which later allowed me to transition into a leadership type position.

We both hustled hard in our 20s to build skills and financial stability.

2. Moved back home with our parents

When we were 19 and 20, we made the decision to move back in with Shauns parents for about 2 years. We joined bank accounts when we moved out of home together at 18 and it helped us keep each other accountable for our spendings. We would actually save one of our pay and live off the other.

It didn’t mean we didn’t have a life, our two month Euro- trip ticking off 14 countries before settling down and buying our first home is proof of this. For us it has always been about balance.

3. Bought a house at 22 and 23

We purchased our first home in one of Newcastle’s outer suburbs while everyone else was still out partying. It wasn’t fancy, but it was home and a smart move that gave us security and a strong base.

4. Go to the pub to do our weekly budget…

Not even kidding though, budgets are boring so we thought why not bring our notepad and crunch numbers whilst having a beer.

5. At home hair cuts

Instead of going to a barber every 6 weeks, I bought a set of clippers and cut the boys hair. I even took the clippers to NZ!

As for myself, I get hair dyed balayage once in a blue moon instead of a high maintenance colour which saves us so much money compared to when I would get a full head of blonde foils.

6. Broadened our knowledge in every spare moment

Shaun and I attended numerous property workshops, listened to self help books and hundreds of hours of podcasts to broaden our knowledge on the property market and money strategies.

Looking back now, I find it funny that we were so committed to our strategy that I clearly remember listening to Rich Dad, Poor Dad (a property book) on the beach in the Phillipines on our honeymoon.

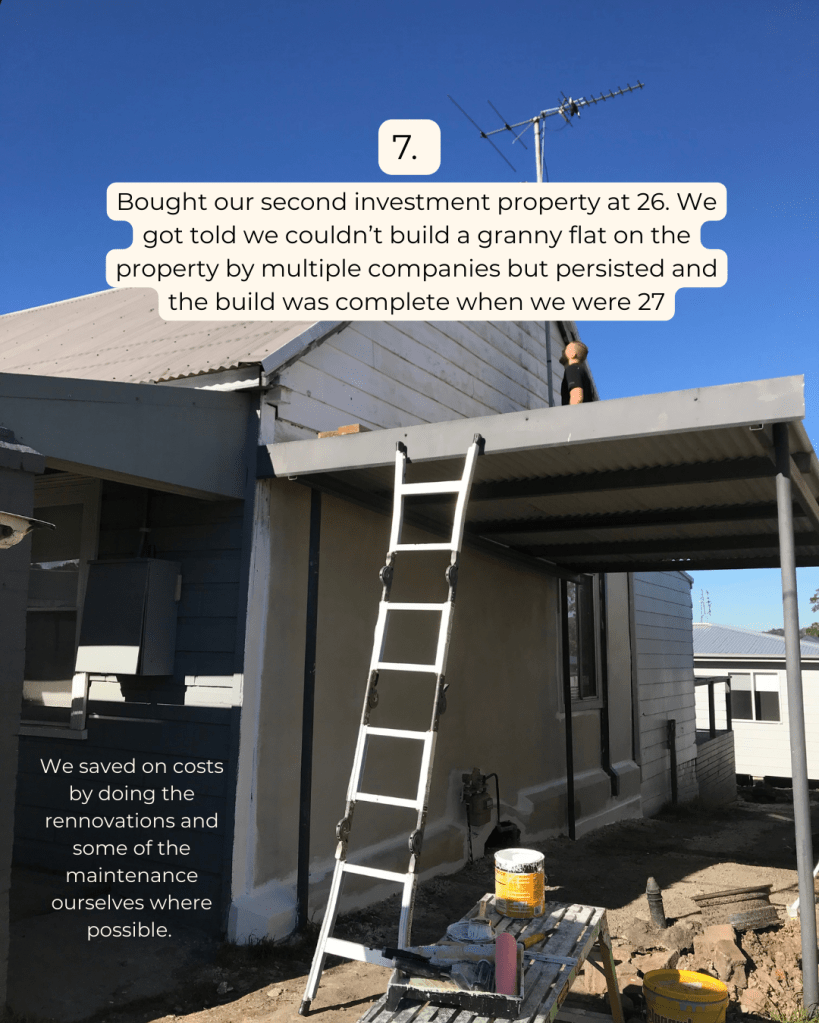

7. Bought our second investment property at 26

After lots of research we bought an investment property in a “blue chip” area. Our strategy was for cash flow with intentions on using the income whilst on the road.

We got told we couldn’t build a granny flat on the property by multiple companies but persisted and the build was complete when we were 27.

We saved on property costs by doing the renovations and some of the maintenance ourselves where possible.

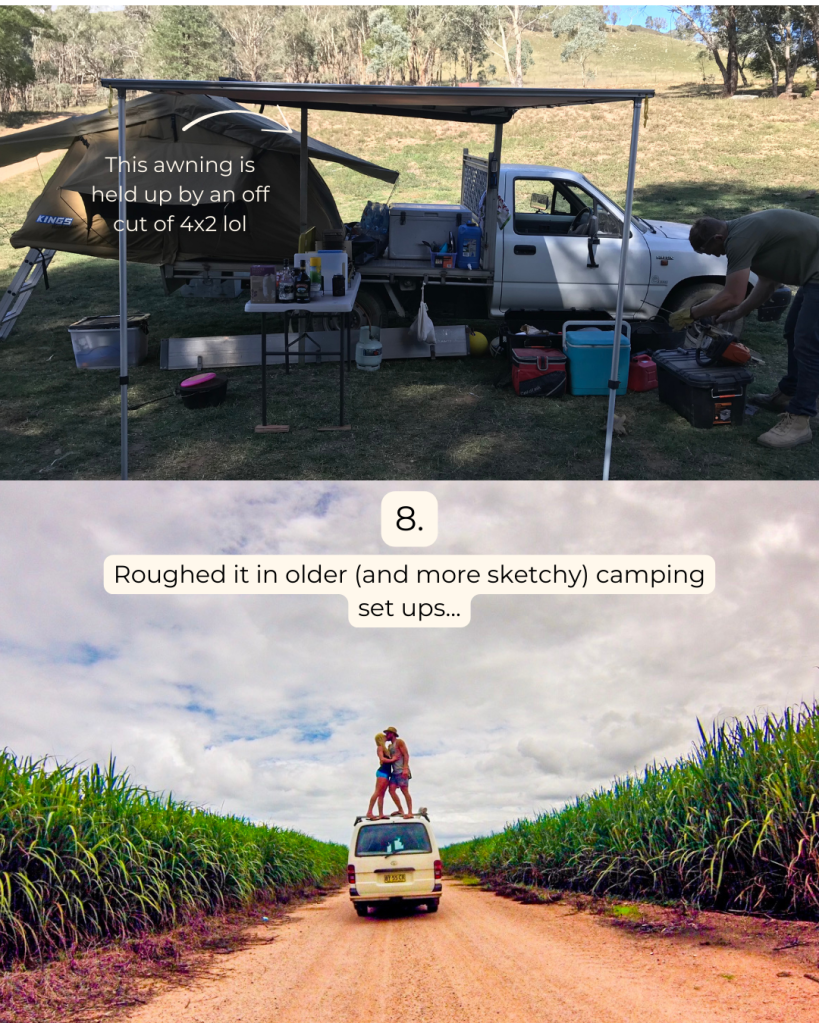

8. Roughed it in older (and more sketchy) camping set ups rather than buying brand new…

Our camping set ups over the years:

1. A single swag (do not recommend for two people)

2. Rooftop tent on the back of Shauns $7000 hilux

3. 2004 Toyota Hiace van – Shaun built a bed in the back (ours first taste of van life!)

4. 2011 Toyota Hiace – we spent more on fitting out because we knew what we wanted (it was still budget)

5. 1980s Millard caravan – We renovated and bought back to life before travelling Australia in it for 2.5 years with our baby.

6. 2017 New Age Manta Ray caravan (our newest Australian caravanning set up)

7. 2004 Mercedes-Benz Sprinter Motorhome (what we are travelling around in New Zealand)

9. Quickly bought our 3rd (technically 4th) investment property before our son was due

Anyone that has ever gone for a home loan knows that children effect your borrowing capacity meaning you can’t borrow as much money because you have a dependent that is costing you and your family more money. For that reason we quickly bought our 4th investment property when I was 18 weeks pregnant with Max.

10. Never got a car loan

Shaun has always had s*** box work utes (as he liked to call them) all worth less that $10K.

11. Bought and renovated an old Millard caravan for $6000 instead of spending $60, 000+ on a newer van.

Originally the plan was to buy this old caravan to see if we liked caravanning before buying something newer but we fell in love and ended up taking the old girl around Australia when our son was just 6 months old. It didn’t have a shower so we showered outside but the extra money we had by saving it on our set up cost meant we could travel for longer- worth ‘roughing it’ for a bit in my eyes.

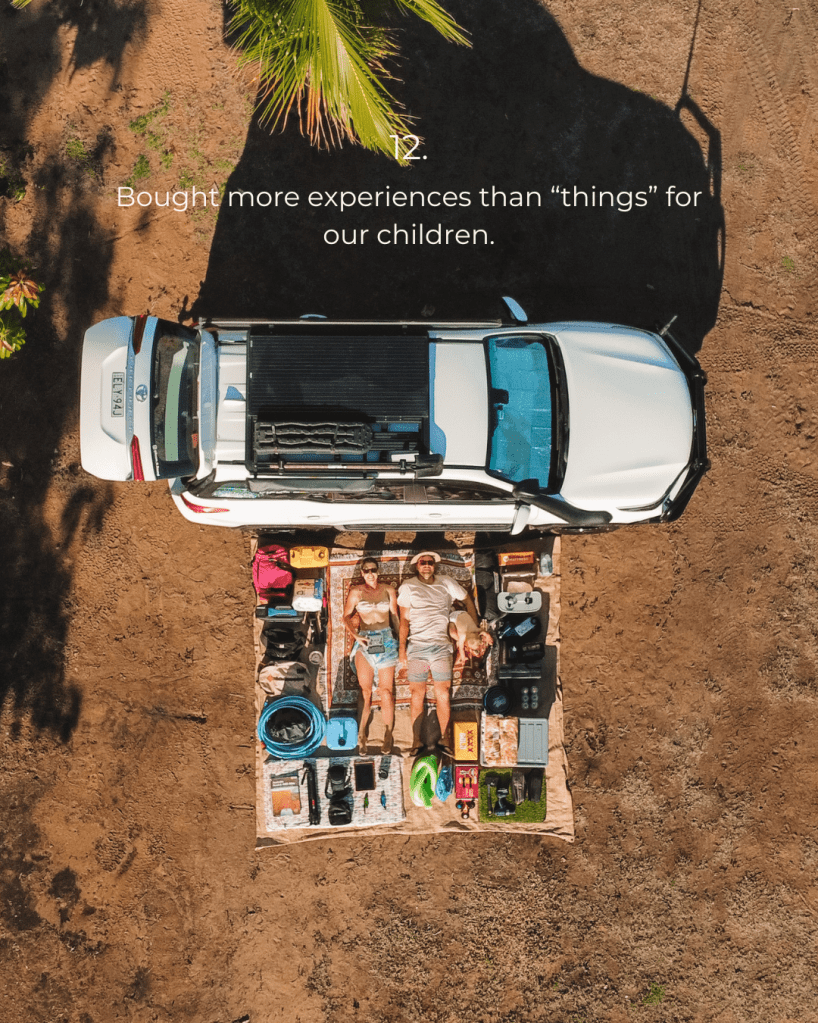

12. Bought more experiences than “things” for our children

This is a MASSIVE one for us that we live by! Newsflash, kids don’t need “stuff” and our kids are testament to this. Give our kids the option to stay inside and play with a toy or go jump in puddles outside they will choose the outdoors any day of the week!

The memories for us far outweigh the “things” we could buy our children all to keep up with the Joneses.

13. Stayed at free camps where possible when travelling Australia (and now New Zealand!)

We installed a full lithium electrical system in our Millard caravan that was worth more than the caravan itself so we could comfortably do so with a 6 month old. Yes it was a big outlay in costs initially but in the long run we would have saved so much money by free camping.

This plays a role in prioritising experiences over things for example we would much prefer to freedom camp (or free camp we call it in Australia) rather than pay $70 for a caravan park that we could spend that money on going to a local pool, getting ice creams, wildlife experiences… and the list goes on.

14. Shop at Aldi (now PakN’Save in NZ) for groceries, the local Op shops and my favourite brand sales for clothes, toys and books where ever possible

I might be slightly addicted to op shopping, anyone else?! From furniture to toys to clothes, we embraced secondhand. Marketplace and op shops became our best friends.

When we first arrived in NZ we went to Woolworths since it is familiar and I was SHOCKED by how expensive everything was! Everything was at least $2 more than our Aussie prices. If you’re getting one or two things, fair enough you’d pay it but when doing a weekly shop this adds up quick! We’ve found PakN’Save is the cheapest for groceries whilst in NZ and they are everywhere!

15. Made the decision to sell one of our investment properties to pay down loans and to fund our travel in New Zealand

Rule number one we have learnt after all of our research is that you never sell property because it always goes up in value. So, this decision is not something we took lightly. We worked hard to be able to buy this investment property and build the granny flat so as sad as it was to see that hard work gone, it was also so rewarding to reap those rewards in other ways.

16. Bought (and plan to sell) a motorhome in New Zealand

Instead of hiring, we purchased a motorhome in NZ for $53,000 NZD with the intention of reselling it when we’re done. It’s a bold move, but financially it makes far more sense than spending that same amount of money travelling NZ in a rental for the same amount of time.

The Big Lesson

We are sharing this not as a how to guide but rather a little insight into how we made it work for us. The journey might be hard, messy, and even a little crazy at times—but hard work, confidence, and a willingness to step outside the norm can create the freedom to live your dream.

We always say: “If your dreams don’t scare you, you’re not dreaming big enough.”

❤️ Britt

Instagram: @roam_n_round

Facebook: Roam N Round

TikTok: @roamnround

Leave a reply to Shaun Cancel reply